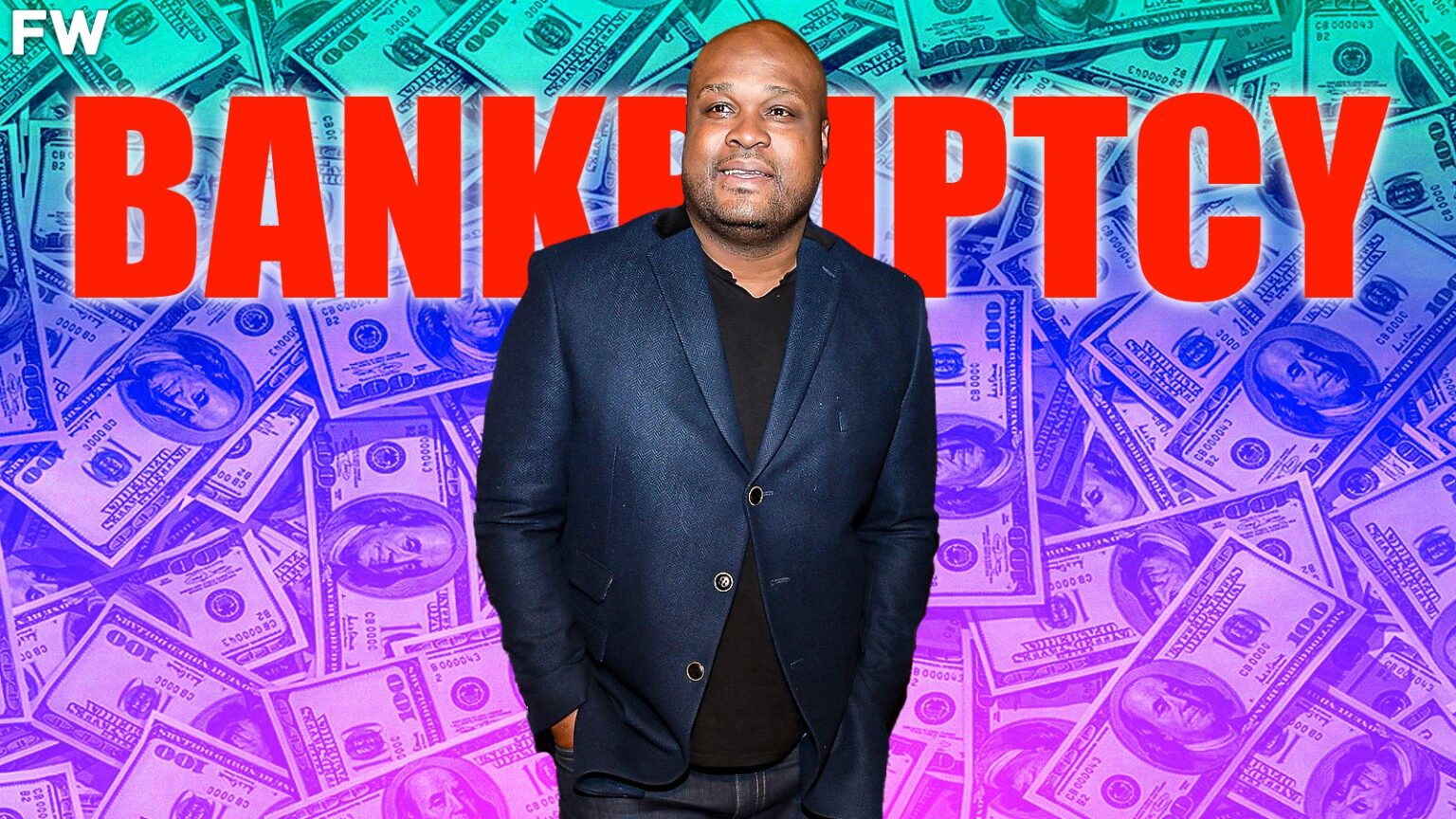

Former NBA player Antoine Walker once had a net worth of $108 million. But despite his massive wealth, he ended up filing for bankruptcy in 2010.

Now, a decade later, Walker has turned his financial situation around and is using his experience to help others avoid the same mistakes he made. In this article, we’ll take a deep dive into the financial lessons that Antoine Walker has learned through his own journey.

From living within your means and avoiding bad investments to the importance of financial education, these lessons will be valuable for anyone looking to build a secure financial future. So if you’ve ever struggled with managing your finances or just want to learn from someone who has been there, read on to discover Antoine Walker’s money lessons and how they can help you achieve financial success.

Antoine Walker’s Financial Problems To His Successful Turnaround

Antoine Walker’s rise to fame and fortune is nothing short of impressive. Born and raised in Chicago, he played high school basketball at Mount Carmel High School.

He then attended the University of Kentucky, where he played for the Wildcats and helped them win the 1996 NCAA Men’s Division I Basketball Championship Game. After his sophomore year, he was selected as the sixth overall pick in the 1996 NBA draft by the Boston Celtics.

Walker quickly became a key player for the Celtics, earning NBA All-Rookie First Team honors in his first season. He continued to improve his game over the years, becoming a three-time NBA All-Star and leading the Celtics to the Eastern Conference Finals in 2002.

https://www.youtube.com/watch?v=x5c09fRnQ8w

Walker would play 12 years in the league and win the NBA championship in the 2005-06 season, alongside Dwyane Wade and Shaquille O’Neal on the Miami Heat. During his time in the NBA, Walker earned a fortune, signing contracts worth over $108 million.

Off the court, Walker was known for his flashy lifestyle. He owned multiple homes, cars, and expensive jewelry. Walker also liked to outdo his friends. If one of his friends bought an expensive car or outfit, Walker would go out and buy one even more expensive.

Walker also had an addiction to gambling, which saw him throw away a lot of money. He was also known for his generosity, often giving money to friends, family, and even strangers.

However, despite his wealth and success, Walker faced financial troubles in the years following his retirement from the NBA. He made several poor financial decisions, including investing in failed real estate projects and gambling away large sums of money.

Walker retired from playing in 2008, and just two years later, he was filing for bankruptcy. He did the unthinkable and blew through his entire $108 million NBA salary.

It took some time, but Walker has bounced back and has overcome his enormous debt. Walker, along with former NFL star Bart Scott, were hired to financial service firm Morgan Stanley’s new Global Sports and Entertainment division in 2015.

This gave Walker the platform to tell his story and to give tips to young athletes about how not to lose their money, as he did.

“When I went through my financial difficulties and ultimately filed for bankruptcy in 2012, I really got a chance to see all of the mistakes that I made,” Walker said in an interview with HoopsHype.

“I indulged and I was uneducated, which is what led to being bankrupt. When I went through all of that, I learned a lot and I wanted to turn my negative story into a positive story by helping others avoid the mistakes I made. I realized this could serve as a healing process for me while helping others. I want to be open and transparent to these young athletes about the mistakes that I made, so that they don’t go down the same road. When I do these presentations, I’m honest with them about the challenges that they’re going to face.

“I try to teach guys to build the proper team around them – from their agent to their financial adviser to whoever is investing their money. Also, I try to get them thinking about generational wealth. When a guy comes into the league at 18 or 19 years old, he’s usually thinking short-term and materialistically. He’s not thinking about generational wealth and making sure he’s putting enough money aside for when he’s 40 or 50 years old. He isn’t thinking about providing for his future kids or future grandkids. A teenager usually isn’t thinking like that, so I try to put those things in their head.”

Antoine Walker’s story is an important reminder that money management is an important life skill that everyone should learn. It’s a cautionary tale about the dangers of living beyond your means and not planning for the future.

However, it’s also a story of resilience and determination. Despite declaring bankruptcy and losing millions of dollars, Antoine Walker bounced back and rebuilt his life. He used his experience to educate others and help them avoid the mistakes he made.

One of the most valuable lessons we can learn from Walker’s story is the importance of seeking financial advice and guidance. Whether it’s from a financial advisor, a mentor, or a trusted friend, having someone to help you navigate the complex world of finance is crucial.

Additionally, it’s important to have a solid financial plan that includes a budget, savings, and investments. By creating a plan and sticking to it, you’ll be in a better position to achieve your financial goals and avoid financial pitfalls.

In conclusion, Antoine Walker’s story is a powerful reminder of the impact that financial mismanagement can have on our lives. But it’s also a testament to the power of determination, education, and planning. By learning from his mistakes and taking steps to manage our own finances, we can all find success and security in our financial lives.

We sincerely appreciate and respect you as a reader of our site. It would help us a lot if you follow us on Google News because of the latest update.

Thanks for following us. We really appreciate your support.